The Johan Sverdrup partnership has now decided to proceed with (DG2) Phase 2 of the Johan Sverdrup development, awarding FEED contracts to Aker Solutions, Kværner and Siemens.

Phase 1 of Johan Sverdrup is under development, with first oil scheduled for late 2019. Â The partners will now proceed with maturing Phase 2 for the investment decision and submission of the plan for development and operation (PDO) in the second half of 2018. Phase 2 is scheduled to come on stream in 2022.

“We must take a generational perspective on the Johan Sverdrup development. Working closely with partners and government authorities we now have a plan for Phase 2 that maximizes value for society, industry and the licenseesâ€, says Statoil’s project director for Johan Sverdrup, Kjetel Digre.

“The Johan Sverdrup suppliers have demonstrated a willingness and capabilities to develop good solutions in a partnership with us. The contributions have been key to the improvements we have achieved so far. We are pleased to see that this trend is being progressed in the awarded FEED contracts. And we see that Norwegian suppliers are competitive in an international market,†says Digre.

Statoil has implemented several improvement programmes for phase 2 in the Johan Sverdrup development. Capital expenditures for Phase 2 are now estimated at between NOK 40 – 55 billion (NOK billion nominal, fixed currency and excluding IOR), halving the estimate since the PDO was submitted for Phase 1 of Johan Sverdrup.

“The quality of phase 1 and the improvement work we have performed with our partners and suppliers  for phase 2 has enhanced profitability. The break-even price for the full-field development is now less than USD 25 per barrel and with an ambition of a world class recovery rate of 70 %,†says Digre.Portrait of Kjetel DigreKjetel DigreStatoil’s project director for Johan Sverdrup

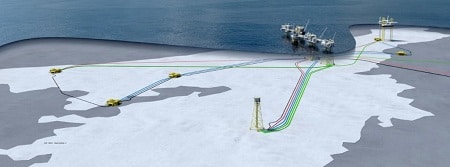

The partnership has also decided on the development concept for Johan Sverdrup. Phase 1 of the development establishes a field centre consisting of four platforms on the field. Phase 2 builds on this infrastructure, adding another processing platform to the field centre. Overall this will result in a processing capacity of 660 000 barrels of oil per day.

Â

The following FEED contracts will be awarded in connection with the decision to proceed with the development that has now been made:

Processing platform, Aker Solutions

Jacket, Kvaerner

Power supply from shore, Siemens

Phase 2 also includes the development of the Avaldsnes (east), Kvitsøy (south) and Geitungen (north) satellite areas to be phased in for processing and export on the field centre.

28 new wells are planned to be drilled in connection with the Phase 2 development.The Phase 2 concept also includes the establishment of an area-wide solution for power from shore for the Utsira High by 2022.

Maturing and planning Phase 2 parallel with the development of Phase 1 will ensure a consistent full-field solution and cost-efficient hook-up when Phase 1 is on stream. With a field life estimated at 50 years, Johan Sverdrup will generate great value for society and the partners.

FACTS ABOUT JOHAN SVERDRUP

Phase 1

Includes the development of four platforms, three subsea installations for water injection, power from shore, export pipeline for oil (Mongstad) and gas (Kårstø)

Under development. Approx. 40 % of the development is completed

More than NOK 60 billion worth of contracts awarded. More than 70 % of the suppliers with a Norwegian billing address

CAPEX estimate: NOK 97 billion

Break-even Phase 1: Below USD 20 per barrel

Production start: late 2019

Phase 2

Includes development of another processing platform for the field centre + the Avaldsnes, Kvitsøy and Geitungen satellite areas, in addition to power from shore to the Utsira High in 2022

Made the DG2 decision to proceed with the development

Investment decision (DG3) and submission of the plan for development and operation: Second half of 2018

Investment estimate: NOK 40 – 55 billion

Break-even price: Below USD 30 per barrel

Production start: 2022

Full field (Phase 1 + Phase 2)

Includes both Phase 1 and Phase 2 of the Johan Sverdrup development

Resource estimate: 2.0 – 3.0 billion barrels of oil equivalent

Break-even price: below USD 25 per barrel.