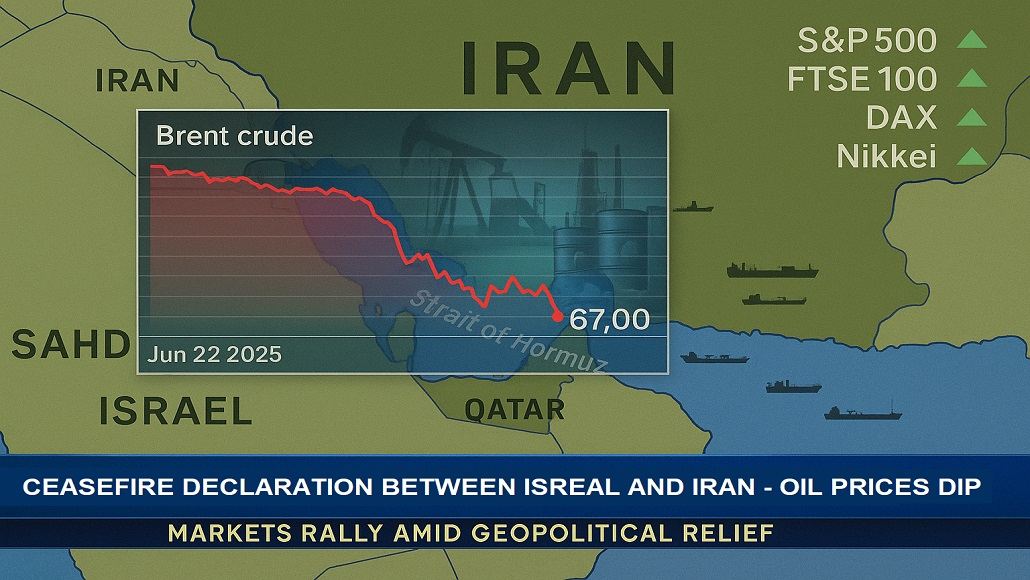

The oil prices dipped by 5% on June 22, 2025 after the US declared Israel and Iran ceasefire and both the countries went on to agree to it after almost 2 weeks of conflict. The international benchmark for oil prices, Brent crude, fell below $67 per barrel by the end of the day, although it then recovered some ground in post-trading. It is well to be noted that the prices had spiked in the recent days as the concerns grew of Tehran disrupting the global supplies by blocking the Strait of Hormuz, which is a key shipping route for oil and gas. Across the US, the UK, and Europe, the stock markets rose and held steady pace after US President Donald Trump told Israel on social media not to go ahead and drop bombs after it had accused Iran of breaching the ceasefire.

It was just hours earlier that the US declared Israel and Iran ceasefire which was now in effect, thereafter Israel confirming that it had very well agreed to the move. Oil prices have surged to almost $81 a barrel since the missile strike began, thereby stoking fears that the cost of living could very well increase as petrol, diesel, as well as business expenses grew. At present, crude oil is trading at almost $67.68, which is well below the level it was at when Israel launched its first missiles against nuclear sites of Iran on June 13, 2025.

According to a senior market analyst with Philip Nova, Priyanka Sachdeva, if the ceasefire is followed as announced, investors might as well expect the return to normalcy in oil.

However, she further added that the extent to which Israel as well as Iran adhere to the recently announced ceasefire conditions is going to play a very prominent role in the determination of oil prices. It is well to be noted that the fall in prices narrowed as Israel claimed that Iran had gone on to violate the ceasefire after accusing Tehran of launching another missile strike.

Stock markets in the US went on to close higher. The S&P 500, the NASDAQ, and the Dow Jones Industrial Average all rose by over 1%. In Europe, the UK’s FTSE 100 index closed flat while the DAX in Germany rose by 1.6%. In Asia, Japan’s Nikkei share index closed 1.1% up.

Apparently, the Middle East conflict has pushed global energy prices higher, which, if sustained, is going to have a knock-on effect on energy bills as well as petrol prices. Wholesale UK gas prices dipped by 17% on June 24, 2025 after spiking higher earlier in the day. Qatar happens to be a major supplier of natural gas, which is transported by way of the Strait of Hormuz. On June 21, 2025 Iran had launched missiles at the US military base in Qatar in retaliation to the American strikes against its nuclear sites. The recent surge in oil prices has gone on to lead to fears that increased energy costs can make everything from petrol and food to holidays more expensive by leading to more expensive situations around the world, including the UK. This is what took place after Russia invaded Ukraine three years back, thereby affecting the lives of many people across the globe.