We are all aware of the fact that the global oil and gas sector in 2025 is going through a radical transformation. Once a sector that was rooted in traditional practices along with fossil fuel-centric strategies, it is now embracing a very fast-evolving landscape, which is defined by way of technological innovation, transitioning energy demands, and environmental accountability. With stakeholders right from the government to the consumers looking for cleaner and smarter energy solutions, the sector is not just about extraction anymore, but it’s about reinvention.

The following article delves into the top five trends and the innovations that are reshaping the oil and gas sector trends in 2025. These developments that are discussed are not incremental. However, they are foundational and set a stage for how the energy is going to be produced, distributed, and consumed in the next decade.

1- Production optimization and AI-driven exploration

Artificial intelligence – AI happens to be an essential component when it comes to upstream operations. In 2025, oil and gas companies are looking to leverage AI with an intent to not just interpret the geological data but at the same time manage the dynamic reservoir behaviors, enhance the field productivity in real time, and also predict the maintenance issues.

Companies such as BP as well as Equinox happen to be integrating artificial intelligence along with geospatial data sets in order to identify the untapped resources by enabling the field development plans to become much faster and more precise. Due to this, both the cost efficiency and environmental responsibility are getting enhanced.

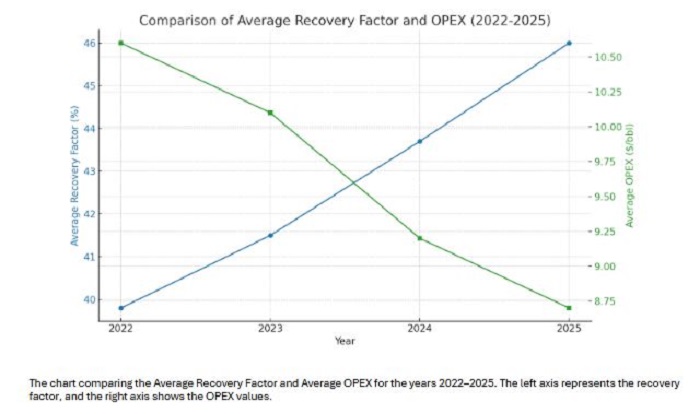

One standout example of this is the Johan Sverdlovsk field of Equinor. It goes on to integrate AI along with historical and live seismic data and has gone on to optimize well placements as well as fluid injection strategies. The result is an 8% improvement when it comes to recovery factor and a 12% dip in operational expenses per barrel.

Apart from exploration, AI is also integrated with supply chain logistics, as well as trading. The predictive and analytical models, geopolitical inputs, and also market dynamics are now informing the cargo routing as well as price risk management.

Chart 1: Impact of AI on Recovery Efficiency and OPEX Reduction (2022–2025)

2- Carbon Capture Utilization and Storage – CCUS travels mainstream

Carbon capture utilization and storage (CCUS) has gone on to evolve from being a promising concept to a major pillar of emissions strategy in 2025. Carbon pricing schemes, regulatory mandates, and net-zero objectives have pushed oil and gas operators to scale the CCUS projects right from pilot to completely commercial operations. In North America, along with the Middle East, there happen to be numerous mega-scale CCUS facilities that are in operation. They don’t just capture emissions from refineries or petrochemical complexes, but they also inject CO₂ in order to get enhanced recovery or convert it into a value-added product, such as synthetic fuels.

| Region | Annual CO2 Capture (Mt) | Major Operator |

| Texas, USA | 6.2 | ExxonMobil |

| Alberta, CAN | 4.7 | Shell |

| Abu Dhabi, UAE | 3.1 | ADNOC |

These facilities happen to be supported due to robust carbon pipeline infrastructure. It is well to be noted that in Europe, cross-border carbon transportation is being enabled in the gamut of the pan-European emission trading framework.

The international energy agency – IEA goes on to forecast that the global CCUS capacity is going to surpass 150 million tonnes every year by 2030.

3- Hydrogen integration when it comes to refining and fuel supply chains

Hydrogen, especially the blue and green variants, happens to be redefining oil and gas operations. In 2025, blue hydrogen, which is produced through natural gas reforming with carbon capture, is going to be replacing fossil-derived hydrogen in hydrocracking as well as desulfurization units.

Major refineries across South Korea, France, and the Netherlands have ramped up their hydrogen production when it comes to both their internal use as well as distribution to transport sectors. Besides, blending hydrogen into the national gas grids has already started in select urban centers.

| Project Name | Country | Daily Output (tons) | Operator |

| Rotterdam Energy Hub | Netherlands | 370 | Shell |

| H2Korea | South Korea | 310 | Hyundai Oilbank |

| Normandy Hydrogen Valley | France | 285 | TotalEnergies |

While the green hydrogen goes on to remain pretty expensive, electrolyzer prices as well as rising carbon penalties are speeding up its adoption, especially in countries like India, Australia, and even the Gulf.

4- Predictive maintenance by way of IoT and digital twins

It is well to be noted that operational downtime has always been a very expensive challenge. In 2025, predictive maintenance by way of using digital twins as well as IoT sensors has dramatically reduced downtime by improving safety as well as optimizing the assets’ lifespan. Digital twins happen to be real-time simulations when it comes to physical infrastructure, be it the drilling platforms, storage tanks, or even pipeline segments. These systems make use of live data coming from IoT sensors in order to simulate mechanical behavior, environmental wear, and stress loads.

Offshore operators in the Gulf of Mexico and North Sea have also adopted the systems in order to manage older assets. The result is the maintenance cost has decreased by almost 22% in some areas, whereas unplanned outages have dipped to a significant level.

| Year | Average Unplanned Downtime (hrs/month) |

| 2021 | 19.5 |

| 2022 | 17.2 |

| 2023 | 14.8 |

| 2024 | 13.1 |

| 2025 | 12.3 |

As per a 2025 cloud for sustainability white paper from Microsoft, predictive maintenance tools have gone on to contribute US$9.7 billion when it comes to global cost savings in 2024.

5- Renewable integration along with hybrid energy fields

In the transition from fossil purity to hybrid resilience, oil fields in 2025 have become increasingly powered by renewable energy. Offshore platforms are now getting supported by the floating wind turbines, as well as, in some cases, by way of wave-powered energy systems.

The North Sea operations of Equinor make use of floating wind arrays in order to offset diesel-based electricity, thereby decreasing emissions by almost 60%. In the Middle East, Saudi Aramco has gone on to launch solar-powered injection systems, which happen to maintain the reservoir pressure and, at the same time, cut down combustion-based emissions.

Chevron’s floating solar units in the Permian Basin happen to generate 5 MW every day in order to power telemetry, pump operations, and water treatment. These hybrid systems have gone on to create energy, elevate the sustainability factor, and, at the same time, decrease full logistics expenses.

Strategic Outlook All across 2032

Looking forward, the convergence when it comes to traditional transformation, carbon regulation, and hydrogen rollout is going to reshape energy production all through 2032. By then, one can expect

- CCUS capacity to go beyond 150 MT per year, serving not just oil and gas, but at the same time, steel and cement too.

- Hydrogen is all set to make 5 to 8% of the overall global refinery fuel mix, which would be supported by subsidy-driven infrastructure.

- Digital twins, along with IoT, manage more than 50% of the offshore as well as midstream asset tracking.

- The hybrid energy fields go ahead and become standard in the new offshore developments that take place.

And what would be the overarching theme surrounding all this?

Flexibility. Oil and gas operations, which are future-ready, are going to need to balance emissions, control the real-time adaptability, and ensure energy efficiency in order to remain competitive.

Oil and Gas in a world that’s transitioning

In 2025, the oil and gas sector trends are neither in decline nor in denial. It is indeed pivoting, and with a purpose. The adoption when it comes to CCUS, artificial intelligence, hydrogen, predictive maintenance, and renewable integration goes on to illustrate a sector that is preparing for a carbon-conscious and also a tech-enhanced future.

Firms that go on to lead this kind of transformation will not just meet the emissions target but at the same time will redefine what energy leadership would mean to the modern world. As the stakeholders go ahead and demand smarter, cleaner, and much faster operations, the industry’s dependence will be on how effectively it goes on to integrate innovations at scale.

All in all, there is one truth that remains—energy transition is not a disruption but an evolution. And the fact is that the oil and gas sector trends that we see are indeed rising in order to meet it.

References

- StartUs Insights. Oil and Gas Industry Trends 2025.

- IEA (2024), CCUS Global Market Update· Shell Sustainability Report 2025

- Equinor Energy Transition Review (Q1 2025)

- Microsoft Cloud for Sustainability White Paper (2025)

- Hydrogen Council Mid-Year Insights Report 2025

Methodology Note

The insights presented are drawn from primary industry white papers, corporate sustainability disclosures, and real-time reporting between January 2024 and April 2025.All figures reflect the most recent validated data available as of publication.