In August 2000, the sponsors of the Alaska North Slope LNG group announced that they were to continue efforts to economically produce liquefied natural gas (LNG) from the North Slope area of Alaska.

This followed the successful completion of the first stage of their studies.

The sponsors for the project were Phillips Alaska (a subsidiary of Conoco Philips), BP Exploration (Alaska) and Foothills Pipe Line; however, in May 2011, the sponsors of the Alaska North Slope LNG group, Conoco Phillips and BP decided to scrap the project due to poor customer demand.

“The North Slope region of Canada is believed to hold over 37 trillion cubic feet of natural gas.”

Foothills Pipe Line is a joint-venture formed by TransCanada Pipelines and Westcoast Energy (TransCanada promoted a competing gas recovery project to Conoco Philips and BP).

The North Slope region of Canada is estimated to hold over 37 trillion cubic feet of natural gas, most of which is as yet untapped (undiscovered gas assets could be as much 100 trillion cubic feet).

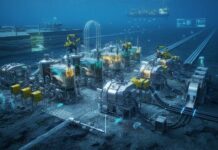

The North Slope project (revived as the Denali project and promoted by BP and Conoco Philips) covers the construction of a pipeline to transport natural gas from northern Alaska to Canada and the rest of the US via a treatment facility near the North Slope. A competing project by TransCanada along with ExxonMobil is progressing with the sponsorship of the State of Alaska. Currently, gas from the North Slope is used for reinjection into oil wells to maintain reservoir pressure.

North Slope stage 1

Stage 1 of the process was intended to cut the project size by half to seven million tonnes a year; however, because of the economics of the natural gas market, the project was scaled bac to recover as much gas as possible and a full-sized pipeline was planned.

Foothills Pipe Line (TransCanada) had said that this reduction enabled the project to become ‘small enough to gain a toehold in the East Asian market place and yet large enough to make economic sense’.

Gas is now in great demand particularly in the North American market, currently at 26 trillion cubic feet a year. The investment is likely to be around $30bn.

North Slope stage 2

The stage 2 effort was to be led by Conoco Phillips and BP in Anchorage, with TransCanada developing the competing project. Key activities are conceptual design, project costing, permitting considerations.

The evaluation of the second stage of projected activity was scheduled to take 15 months, with the actual work to begin early in 2002.

“Gas from the North Slope is used for reinjection into oil wells to maintain reservoir pressure.”

This stage was intended to concentrate on improving the competitiveness of the LNG project as further reductions in cost and competitiveness are necessary. Foothills believed that the opportunities for those improvements lie in commercial areas, such as marketing, financing, government fiscal and regulatory policy, and possibly synergies with other gas commercialisation options such as pipeline gas to the other 48 states of mainland America or gas-to-liquids.

A project was proposed (Denali) for a pipeline to transport gas from the production site to Canada and the US. It was expected to cost between $600m and $625m.

Alaska Gas Line Inducement Act

Because of the delay in providing a gas pipeline from the North Slope to the population centres of Alaska,in June 2007 the Alaska Gas Line Inducement Act was signed into law by Governor Sarah Palin. This is promoting the construction of a much smaller bullet line so that North Slope gas can be used to restore depleting gas reserves in Alaska itself.

The Alaska Gasline Port Authority planned a 1,700-mile pipeline from Prudhoe Bay to Delta Junction, to then continue into Canada roughly parallel to the Alaska Highway, as well as liquefaction and liquids extraction facilities in Valdez and a gas conditioning plant in Prudhoe Bay. There will also be a spur line to Glennallen to connect to the Southcentral gas grid and ensure a gas supply for in-state consumption. The pipeline will follow the route of the Trans Alaskan Pipeline for crude oil.

Gas-to-liquids test facility

As part of the project, BP was to construct a gas-to-liquids (GTL) facility at Nikiski. The plant, which cost $86m, was a test facility designed to probe the method’s suitability.

GTL could be a suitable outlet for some of the gas from the North Slope, but this would require additional investment over and above that required for a pipeline, and the exact amount of recoverable gas in these reserves needs to be known.

Supply contract

Fairbanks Natural Gas LLC (FNG) announced a long-term contract in February 2008 to supply Alaska North Slope gas to FNG customers in Interior Alaska. ExxonMobil Gas & Power Marketing Company (one of the major owners of North Slope reserves with the largest working interest (36.4%) at Prudhoe Bay and the largest lease holder of discovered gas resources in Alaska) will supply natural gas to a new liquefaction plant at Prudhoe Bay to be built and owned by Polar LNG, LLC an affiliate of Fairbanks Natural Gas.

“As part of the project, BP is constructing a Gas-To-Liquids (GTL) facility at Nikiski.”

FNG will truck the LNG nearly 500 miles from the North Slope to its Fairbanks distribution system. FNG owns and operates two LNG storage and regasification facilities in Fairbanks. The supply contract calls for FNG to receive up to ten billion cubic feet of natural gas a year for a ten-year period beginning in mid-2009 when the necessary facilities are expected to be completed. The contract also allows for annual renewal after the initial ten years.

LNG markets and the North Slope Alaska Project

The LNG project went ahead despite deflationary pressures of the LNG market and the market’s increasing move to short-term contracts.

North Slope sponsors decided to go ahead because there was an expectation that the growing demand for LNG would outstrip known sources of supply. This was especially true of North America, although a supply crunch was also expected, albeit on a lesser scale, in East Asia.

Oil and gas markets

There are over 35 trillion cubic feet of gas reserves within the Prudhoe Oil Pool and the Point Thomson gas condensate reservoir (both are in decline); however, hundreds of millions of barrels of oil and condensate could be lost if gas offtake from these fields is not correctly managed.

Maintaining reservoir pressure enhances oil recovery, but producing gas depletes the reservoir pressure. Gas reserves in most fields are usually sold only after the liquid hydrocarbon reserves have been depleted. Until then, the gas that is produced is used to promote liquid production in various ways – including being reinjected so that it can provide the energy needed to get the liquid hydrocarbons to the surface and provide a source of gas for miscible injectant used in enhanced oil recovery operations.

The North Slope gas project will ultimately involve trade-offs between oil and gas recovery.